35+ debt to income ratio for mortgages

Ad Calculate and See How Much You Can Afford. Web Monthly debt obligations of 3000 divided by gross monthly income of 7000 is 0429.

House For Low Income Finding The Right Mortgage On A Budget

Bank Is One Of The Nations Top Lenders.

. Get Access to Reviews of Top Rated Mortgage Lenders. Apply Get Pre-Approved Today. Save Money Time Prequalify in Min.

We Can Help You Discover Your Options. If your student loan balance is 100000 that means 1000 goes toward calculating your DTI. When youre thinking about lowering or maintaining your DTI ratio youll want to avoid making any big purchases.

Lock Your Rate Today. Web Homebuyers I cannot stress enough the importance of your Debt-to-Income DTI ratioYour DTI is a crucial factor in determining whether you qualify for a mo. Save Real Money Today.

Web Here are debt-to-income requirements by loan type. Web There are 108 banks in the Russell 3000 Index RUA -170 that had total assets of at least 100 billion as of Dec. Very important to know what your debt to income ratio is before applying for loans.

Ad Eased Requirements Make Qualifying For Lower Rates A Snap. Loans backed by the Department of Veterans Affairs usually have a DTI maximum of 41. Lock In Your Low Rate Today.

Debt can be harder to manage if your DTI ratio falls between 36 and 49. Web A debt-to-income ratio of 35 or less usually means you have manageable monthly debt payments. See if You Qualify For a 0 Down VA Home Loan.

Ad Compare the Best House Loans for March 2023. Ideally your DTI ratio should be 35 or less. Plug your numbers into our debt-to-income ratio calculator above and see where you stand.

So Bobs debt-to-income ratio is 32. Now its your turn. Save Money Time Prequalify in Min.

Web Even if you can realistically afford it taking on a new debt or adding to your credit card balance will only drive up your DTI. Web In general lenders prefer that your back-end ratio not exceed 36. Well help you understand what it means for you.

Youll usually need a back-end DTI ratio of 43 or less. Get Instantly Matched With Your Ideal Mortgage Lender. Conventional Loans Dont Have To Be Complicated.

Multiply by 100 to get 429 or a DTI ratio of 43. Under the old FHA lending guidelines 1 of your student loan balance goes toward your DTI. Ad 2nd Mortgage Lenders Easy Process 100 Online Fast Approval Best Rates for 2023.

FactSet provided AOCI and total equity capital data for 105 of them. Heres how lenders typically view DTI. Web To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032.

That means if you earn 5000 in monthly gross income your total debt obligations should be 1800 or less. Ad Calculate Your Payment with 0 Down. Ad 2nd Mortgage Lenders Easy Process 100 Online Fast Approval Best Rates for 2023.

Web Banks use this ratio to help determine how much they will loan you. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Web To calculate debt-to-income ratio divide your total monthly debt obligations including rent or mortgage student loan payments auto loan payments and credit card minimums by your gross.

Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. Juggling bills can become a major challenge if debt repayments eat up more than 50 of your gross monthly income. Web To qualify for an FHA loan you generally must have a FICO score of at least 580 and a debt-to-income ratio DTI of 43 or less including student loans.

Hold off on pulling the trigger on any purchases for now. Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage. If your home is highly energy-efficient and you have a high credit score you may be able to have a DTI as high as 50.

Web Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you money. Ideally your DTI. Ideally lenders prefer a debt-to-income ratio lower than 36 with no.

Avoid new debtbig expenses. Web To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments child support alimony etc. To calculate your estimated DTI ratio simply enter your current income and payments.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. 4 VA loans. Get Access to Reviews of Top Rated Mortgage Lenders.

Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Ad Eased Requirements Make Qualifying For Lower Rates A Snap. Multiply that by 100 to get a percentage.

1 2 For example assume your gross income is. 36 DTI or lower. If youre seeking a mortgage use your potential.

Web Second your student loans get factored into your debt-to-income DTI ratio which is what you owe in relation to what you earn. Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online.

Ex 99 2

What Is The Best Debt To Income Ratio For A Mortgage Bankrate

What S A Good Debt To Income Ratio For A Mortgage Mortgages And Advice U S News

![]()

Debt To Income Ratio Calculator The Motley Fool Uk

What S A Good Debt To Income Ratio For A Mortgage

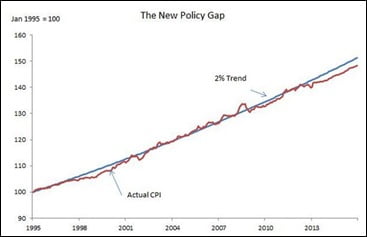

Inflation Control And Mortgage Rates Mortgage Rates Mortgage Broker News In Canada

What S A Good Debt To Income Ratio For A Mortgage

Debt To Income Ratio Calculator What Is My Dti Zillow

:max_bytes(150000):strip_icc()/me_jpeg__chris_murphy-5bfc262746e0fb0051bcea2f.jpg)

Debt To Income Dti Ratio What S Good And How To Calculate It

Most Banks Move To 30 Year Conventional Amortizations Mortgage Rates Mortgage Broker News In Canada

Fha Loan Calculator Check Your Fha Mortgage Payment

Formfree Releases Residual Income Knowledge Index An Intelligent New System For Assessing Borrowers Ability To Pay To Lenders Nationwide Send2press Newswire

What Is Debt To Income Ratio Cain Mortgage Team

Bond Market A Tad Antsy About Inflation Not Just Vanishing One Year Yield Nears 5 Mortgage Rates Back At 6 5 Wolf Street

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Understanding Debt To Income Ratio For A Mortgage Nerdwallet